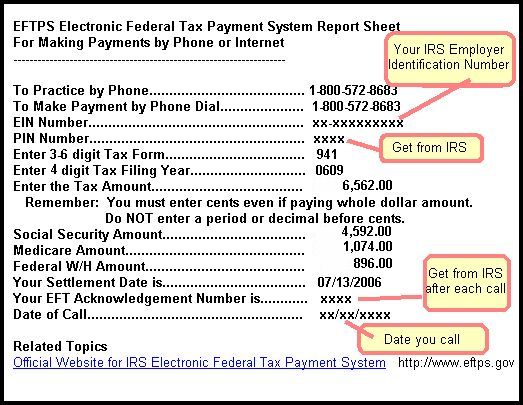

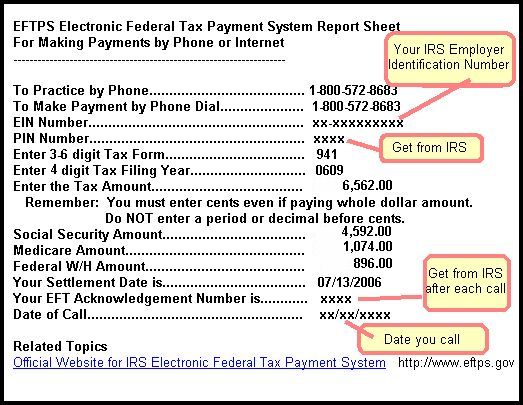

EFTPS Report

This report is printed when you update each payroll.

The EFTPS (Electronic Federal Tax Payment System), is a special report containing all the data required to make your Payroll deposit via the Internet or Phone. To make your payment to the IRS over the internet, go to (http//www.eftps.gov), you will have to register and receive a password for your company. To make payments via the phone, use the phone number listed on the report.

The values here should correspond to your payroll report.

NOTES ON FIELDS

EIN NUMBER: This is your IRS Employer Identification Number (Federal ID Number as stored in your Company Headings File).

The following fields are not completed - as only you will know their values.

PIN NUMBER: When you register with the IRS, at http://www.eftps.gov for Internet filings, they will issue you a PIN number. It is known only to you, so be sure to write it down. Whoever has been making this filing should know your PIN number. RSI does not.

SETTLEMENT DATE: Date you make payment. Some folks make an automatic wire transfer on date of filing, in that case the date of Settlement and Date of Call would be the same. This is only for your records.

DATE OF CALL: If you use phone for making this filing, it is the date you call. If you use Internet, it is date you filed on the internet. This is only for your recrods.

Related Topics

Official Website for IRS Electronic Federal Tax Payment System http://www.eftps.gov

IRS_94x_and_EFTPS Help System - 07/31/06 6:30am Copyright © 2006, Roughneck Systems Inc.